Page 135 of 2296

Re: Florida State Seminoles

Posted: Tue Jan 24, 2012 6:10 pm

by Bklyn

sardis wrote:I disagree with him on the interest deduction in of itself being a subsidy. The interest expense on the debt used to purchase a business is a legitimate business expense/cash outlay that should legitimately be allowed to off-set any profits from that business. It matches the economics of the deal and whatever they deduct they will eventually have to recognize as gain when they sell. The unfair advantage to the hedge funds and private equity firms is in the characterization of the losses taken versus the characterization of the gain recognized on the end. The losses are ordinary which offset 35% income while the gain is capital recognized only at 15%. I can see that as being unfair. Why should i be able to only pay 15% of the gain on the "recapture" of the losses I took at 35%. Will correcting that advantage it make it fairer? I believe it does. Will correcting it help bringing in more revenue? That's a tough answer, depends on how investors behave in other ways to defer the gains.

Yeah, like I said, that's a bit heavy handed. I think the author is making the case because little of the fund principals' own capital is used in the deal, but they take 20% of the total gains out of the arrangement. However, I am squarely on board with saying carried interest should not be looked at as capital gains/dividend income. I don't think that should be the case with private equity/real estate funds, nor with hedge funds. I've always felt it was a racket. And I don't see these managers (especially in the hedge fund space) as significant job creators (and I don't think they see themselves as that either). It's a convenient skirt to hide behind, if someone wants to offer it. However, the primary focus of these funds is the yield. Everything else is ancillary.

Re: Florida State Seminoles

Posted: Tue Jan 24, 2012 7:12 pm

by sardis

We debate this in our office all the time. Even though we agree that Wall Street hedge funds and equity groups are taking advantage of the benefit, some of us are concened with the small to mid market players who aren't making the multi-millions yet taking on more risk in their arrangements than their Wall Street counterparts, i.e. guaranteeing debt, etc. It is especially sensitive in the real estate industry.

I think there needs to be a hybrid or means testing answer to this, I'm just not sure what that is.

I am a firm believer that the raising of gains to the capital investors does very little in raising tax revenue. As you know, taxes are factored in on ROI and asset value. Raise the taxes you lower the value of the transaction. It would end up being a wash in my mind.

Re: Florida State Seminoles

Posted: Tue Jan 24, 2012 11:45 pm

by hedge

"If Houston cops are behind this, it's actually somewhat brilliant. Otherwise, this is yet another example of a dumbass criminal. Or maybe it's even a pissed off resident who simply came up with a unique way to finally draw attention to an ongoing community horror."

Or maybe the cops really don't care and it's just an honest advertisement by an industrious drug dealer...

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 12:50 am

by Jungle Rat

Um, No.

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 9:21 am

by hedge

So you're saying it didn't work out for you? Sorry to hear it...

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 1:17 pm

by Bklyn

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 1:40 pm

by Hizzy III

Hardly a surprising review, given the publication.

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 3:16 pm

by Bklyn

Bloomberg actually does a decent job balancing their editorializing. The Wall Street Journal is a joke, however, wrt their editorial focus.

He has some good points, other ones he speaks as if he's absolute in his truth and it's just not so. As always in politics, and the discourse that accompanies it, the advocate for one side conveniently leaves off truths in the opposition's favor.

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 4:24 pm

by sardis

Has there ever been a SOTU that was any good?

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 5:10 pm

by hedge

Are you referring to the actual SOTU or to the annual presidential address thereon?

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 5:41 pm

by Bklyn

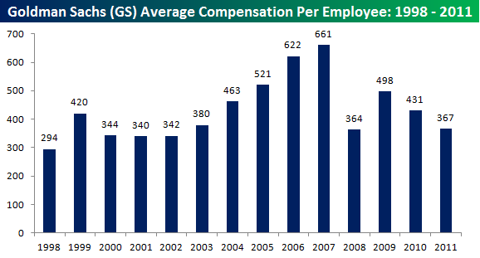

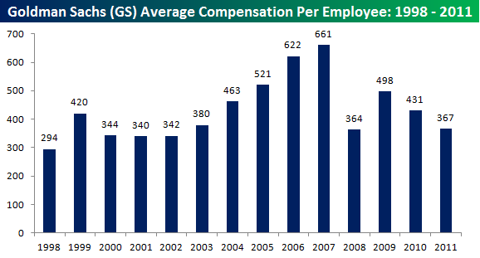

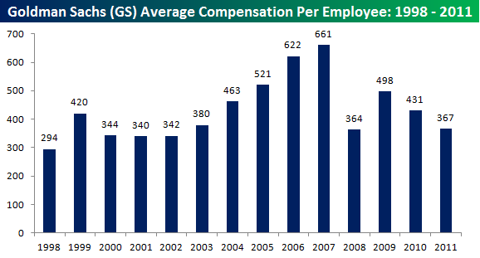

Ahem...looks like the belt will have to be tightened this year because times are so hard (this is bonus, not sal)

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 5:56 pm

by Owlman

Is that compensation for all employees or GS employees?

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 6:04 pm

by sardis

Bklyn wrote:Ahem...looks like the belt will have to be tightened this year because times are so hard (this is bonus, not sal)

Well, they did need cash to buy back Mister Buffett's stock at a premium in 2011....Thank you, AIG bailout.

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 6:42 pm

by aTm

what does 367 represent? $367?

Re: Florida State Seminoles

Posted: Wed Jan 25, 2012 7:24 pm

by Bklyn

Avg bonus per Goldman employee: $367,000.00

Heh, aTm, you really have no idea how the money flows in my part of the country. Single dollars? We don't need no stinking Legend.

Re: Florida State Seminoles

Posted: Thu Jan 26, 2012 10:23 am

by eCat

Supporters of stronger intellectual property enforcement — such as those behind the proposed new Stop Online Piracy Act (SOPA) and Protect IP Act (PIPA) bills in Congress — argue that online piracy is a huge problem, one which costs the U.S. economy between $200 and $250 billion per year, and is responsible for the loss of 750,000 American jobs.

These numbers seem truly dire: a $250 billion per year loss would be almost $800 for every man, woman, and child in America. And 750,000 jobs – that’s twice the number of those employed in the entire motion picture industry in 2010.

The good news is that the numbers are wrong — as this post by the Cato Institute’s Julian Sanchez explains. In 2010, the Government Accountability Office released a report noting that these figures “cannot be substantiated or traced back to an underlying data source or methodology,” which is polite government-speak for “these figures were made up out of thin air.”

More recently, a smaller estimate — $58 billion – was produced by the Institute for Policy Innovation (IPI). But that IPI estimate, as both Sanchez and tech journalist Tim Lee have pointed out, is replete with methodological problems, including double- and triple-counting, that swell the estimate of piracy losses considerably.

So what’s the real number? At this point, we simply don’t know. And this leads us to a second problem: one which is not so much about data, as about actual economic effects. There are certainly a lot of people who download music and movies without paying. It’s clear that, at least in some cases, piracy substitutes for a legitimate transaction — for example, a person who would have bought the DVD of the new Kate Beckinsale vampire film (who is that, actually?) but instead downloads it for free on Bit Torrent. In other cases, the person pirating the movie or song would never have bought it. This is especially true if the consumer lives in a relatively poor country, like China, and is simply unable to afford to pay for the films and music he downloads.

Do we count this latter category of downloads as “lost sales”? Not if we’re honest.

And there’s another problem: even in the instances where Internet piracy results in a lost sale, how does that lost sale affect the job market? While jobs may be lost in the movie or music industry, they might be created in another. Money that a pirate doesn’t spend on movies and songs is almost certain to be spent elsewhere. Let’s say it gets spent on skateboards — the same dollar lost by Sony Pictures may be gained by Alien Workshop, a company that makes skateboards.

As Mark Twain once wrote, there are three kinds of lies: lies, damned lies, and statistics. However true that may be in general, statistics can be particularly tricky when they are used to assess the effects of IP piracy. Unlike stealing a car, copying a song doesn’t necessarily inflict a tangible loss on another. Estimating that loss requires counterfactual assumptions about what the world would have been like if the piracy had never happened — and, no surprise, those most affected tend to assume the worst.

Re: Florida State Seminoles

Posted: Thu Jan 26, 2012 10:24 am

by crashcourse

President tyler born in 1790 has two grand kids alive today. plus he did a slave

http://news.yahoo.com/blogs/sideshow/fo ... 30189.html

Re: Florida State Seminoles

Posted: Thu Jan 26, 2012 11:27 am

by Bklyn

eCat wrote:Supporters of stronger intellectual property enforcement — such as those behind the proposed new Stop Online Piracy Act (SOPA) and Protect IP Act (PIPA) bills in Congress — argue that online piracy is a huge problem, one which costs the U.S. economy between $200 and $250 billion per year, and is responsible for the loss of 750,000 American jobs.

Until they legitimately go after China hackers stealing intellectual property from RSA and a majority of Fortune 500 companies, then you can't convince me that SOPA is about the US govt trying to protect jobs and domestic revenues, moreso than about MPAA and RIAA using their lobbying dollars to close a loop on a business in which they're charging me $20 to watch a crappy 3-D movie (or $15 for an album I'll never see in physical form).

Shit, I used to tape my uncle's albums on cassettes (and then moved to copying cassettes in the late 80s). Was I some mastermind IP pirate as a teen?

Re: Florida State Seminoles

Posted: Thu Jan 26, 2012 1:29 pm

by Jungle Rat

Re: Florida State Seminoles

Posted: Thu Jan 26, 2012 2:17 pm

by sardis

Dooksuks, here is the opportunity you've been waiting for...

http://www.charlotteobserver.com/2012/0 ... -seek.html