Re: Puterbac News Network and Political Discussion Thread

Posted: Mon Jun 06, 2011 6:03 pm

We’ve also seen revenue decreases after tax cuts (Bush 2000-2008) and revenue increases after tax rate hikes (Clinton 1992-2000). Laffer be damned! LOL

Christ now Bush was in office in 2000?

W's tax cuts were NOT fully put in place until 2003. In 2001 the 10% bracket was created and the 15% current bracket changed to 10%. The other bracket didn't change until 2006.

The 2003 cuts accelerated that from 2006 to applying immediately to 2003. The VAST majority of the tax cuts were NOT put in place in 2001 and this includes the capital gains tax cuts. Now I know numbers can be hard to follow, but these are from the frigging WHITE HOUSE OMB of OPRAMA. Not W, but OPRAMA.

Main site: http://www.whitehouse.gov/omb/budget/historicals

Table 2.1 from Main OPRAMA OMB site (above) detailing the revenue by source from 1934 to 2010 including from fed income taxes and capital gains: http://www.whitehouse.gov/sites/default ... st02z1.xls

Bush cuts were FULLY put in place from 2003 forward:

YEAR Ind Inc Tax Rev Cap Gains tax Rev

2003 793,699 131,778

2004 808,959 189,371

2005 927,222 278,282

2006 1,043,908 353,915

2007 1,163,472 370,243

2008 1,145,747 304,346

Tax REVENUE increased every year from 2003 to 2007 and didn't fall until 2008 when the economy lost about 3 million jobs. Both income rates and capital gains rates were CUT, yet revenue increased in both areas.

Lowering taxes gives more people more money that they either spend or invest which leads to MORE people hiring which leads to MORE people working which leads to MORE people paying taxes WHICH leads to MORE revenue despite tax cuts. All of which is a friggin GOOD THING.

So PLEASE quit with the lies that tax revenue declined when W's cuts were put in effect in 2003.

W INCREASED the progressivism of the tax code. The higher brackets paid a GREATER percentage of all income taxes...NOT less.

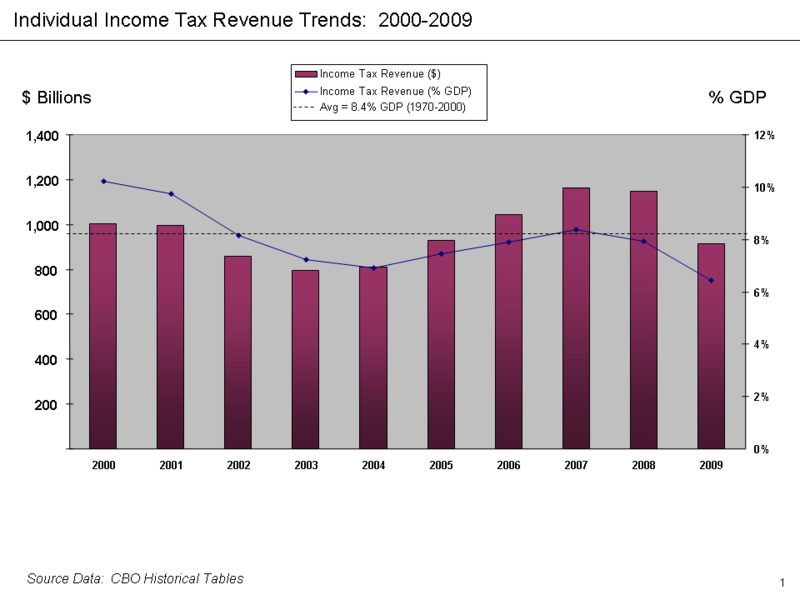

A graphical rep of income tax revenue:

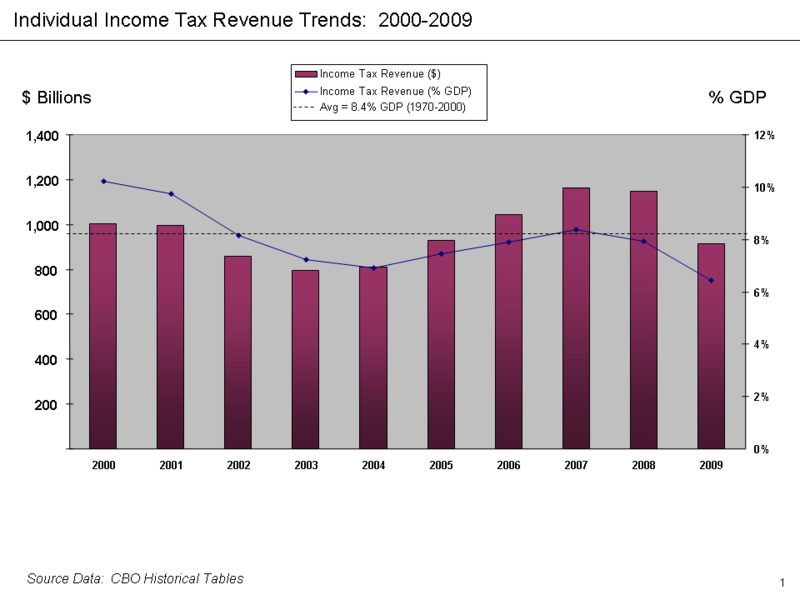

Or a different one:

But the bottom line of this is JOBS and people working and paying taxes is what affects revenue, so you want MORE people working and paying taxes to have the most revenue. To do that you allow people to keep MORE of what they make and they either consume or invest. Both of which encourages people to expand or create new biz and therefore hire more people. Its not rocket science, but it sure seems to be when an idealogical brick wall is in its way.

And to by reducing uncertainty in regulations you allow biz to more accurately predict the cost of an employee will be making it more likely that they will take the RISK, and yes it is a risk, to hire someone. The constant battle and changing of regulations year after year is like a governor on the engine of hiring.

Companies aren't hiring right now because nobody knows what the regs are gonna be in 2 years let alone 10 for opramacare and it effects large and small companies but small even more-so. We are a large company and have enough work that could double certain parts of the company, but the rules and regs of opramacare are a huge risk that is preventing even moderate hiring from occurring. Throw in the deficit and debt and that is why companies large and small are not hiring like they normally would be in this portion of the biz cycle.

Christ now Bush was in office in 2000?

W's tax cuts were NOT fully put in place until 2003. In 2001 the 10% bracket was created and the 15% current bracket changed to 10%. The other bracket didn't change until 2006.

The 2003 cuts accelerated that from 2006 to applying immediately to 2003. The VAST majority of the tax cuts were NOT put in place in 2001 and this includes the capital gains tax cuts. Now I know numbers can be hard to follow, but these are from the frigging WHITE HOUSE OMB of OPRAMA. Not W, but OPRAMA.

Main site: http://www.whitehouse.gov/omb/budget/historicals

Table 2.1 from Main OPRAMA OMB site (above) detailing the revenue by source from 1934 to 2010 including from fed income taxes and capital gains: http://www.whitehouse.gov/sites/default ... st02z1.xls

Bush cuts were FULLY put in place from 2003 forward:

YEAR Ind Inc Tax Rev Cap Gains tax Rev

2003 793,699 131,778

2004 808,959 189,371

2005 927,222 278,282

2006 1,043,908 353,915

2007 1,163,472 370,243

2008 1,145,747 304,346

Tax REVENUE increased every year from 2003 to 2007 and didn't fall until 2008 when the economy lost about 3 million jobs. Both income rates and capital gains rates were CUT, yet revenue increased in both areas.

Lowering taxes gives more people more money that they either spend or invest which leads to MORE people hiring which leads to MORE people working which leads to MORE people paying taxes WHICH leads to MORE revenue despite tax cuts. All of which is a friggin GOOD THING.

So PLEASE quit with the lies that tax revenue declined when W's cuts were put in effect in 2003.

W INCREASED the progressivism of the tax code. The higher brackets paid a GREATER percentage of all income taxes...NOT less.

A graphical rep of income tax revenue:

Or a different one:

But the bottom line of this is JOBS and people working and paying taxes is what affects revenue, so you want MORE people working and paying taxes to have the most revenue. To do that you allow people to keep MORE of what they make and they either consume or invest. Both of which encourages people to expand or create new biz and therefore hire more people. Its not rocket science, but it sure seems to be when an idealogical brick wall is in its way.

And to by reducing uncertainty in regulations you allow biz to more accurately predict the cost of an employee will be making it more likely that they will take the RISK, and yes it is a risk, to hire someone. The constant battle and changing of regulations year after year is like a governor on the engine of hiring.

Companies aren't hiring right now because nobody knows what the regs are gonna be in 2 years let alone 10 for opramacare and it effects large and small companies but small even more-so. We are a large company and have enough work that could double certain parts of the company, but the rules and regs of opramacare are a huge risk that is preventing even moderate hiring from occurring. Throw in the deficit and debt and that is why companies large and small are not hiring like they normally would be in this portion of the biz cycle.