Show me where the dates are wrong. You can't, but go ahead and try.Red Bird wrote:Good idea! Pick and chose which numbers are good as needed.

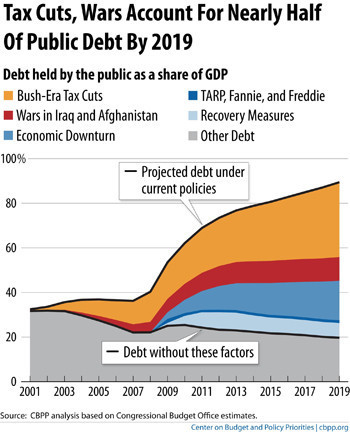

You're dates are wrong, but never mind that. If cutting taxes spurs economic growth, why did tax revenues not increase as much as projected by the CBO before Bush took office?Because they were in full effect in summer 2003 not 2006 and revenues increased every year from 2003 to 2007?"

And why, if cutting taxes is such a boost to the economy, did the revenues actually start to collapse in 2008?

I've been doing this for a while, and I find that when people can't win arguments on the merits they often start tossing insults around. For your own sake, I suggest you stop now, because the ploy only makes you look desperate.Because nobody can be this dumb.

Puterbac News Network and Political Discussion Thread

Moderators: The Talent, Hacksaw, bluetick, puterbac, 10ac

-

puterbac

- Senior

- Posts: 1219

- Joined: Tue Apr 12, 2011 12:11 pm

- College Hoops Affiliation: Tennessee

- Mascot Fight: Bear/Grizzly/Etc

Re: Puterbac News Network and Political Discussion Thread

-

billy bob bocephus

- Junior

- Posts: 718

- Joined: Mon Apr 11, 2011 6:25 pm

- College Hoops Affiliation: Florida State

- Mascot Fight: Bear/Grizzly/Etc

Re: Puterbac News Network and Political Discussion Thread

red bird is the example that shows why that statement is an axiom and not a rule...Because nobody can be this dumb...

- Dora

- Sophomore

- Posts: 322

- Joined: Tue Apr 12, 2011 4:30 pm

- College Hoops Affiliation: North Carolina

Re: Puterbac News Network and Political Discussion Thread

My parents didn't die alone. I moved to Arizona so I could be near them at the end. My brothers also helped. And we did it without askingt them to give up their home or their independence. Them giving up SS & Medicare would have made things more difficult for me & my brothers, not easier.You end up dying alone... and for what? Because adult children can't be bothered to be involved in their parents lives.

Take life with a pinch of salt, a wedge of lime, and a shot of tequila

- Dora

- Sophomore

- Posts: 322

- Joined: Tue Apr 12, 2011 4:30 pm

- College Hoops Affiliation: North Carolina

Re: Puterbac News Network and Political Discussion Thread

What kind of crap is this? I've been contributing to the system all my life & have so far I've gotten nothing. I have never begrudged the elderly getting SS & Medicaid nor have I bitched about paying.puterbac wrote:We've already determined that Dora does give a damn as long as she gets hers. That voting style is why nothing will be done until the there is no choice for something to be done which will be far more painful for the entire country.

Take life with a pinch of salt, a wedge of lime, and a shot of tequila

- It's me Karen

- Junior

- Posts: 659

- Joined: Tue Apr 05, 2011 7:00 pm

- College Hoops Affiliation: Michigan

- Mascot Fight: Big Cat/Tiger/Lion/Etc

Re: Puterbac News Network and Political Discussion Thread

Hack, congrats to you and your little girl!

- Dora

- Sophomore

- Posts: 322

- Joined: Tue Apr 12, 2011 4:30 pm

- College Hoops Affiliation: North Carolina

Re: Puterbac News Network and Political Discussion Thread

Take life with a pinch of salt, a wedge of lime, and a shot of tequila

- Dora

- Sophomore

- Posts: 322

- Joined: Tue Apr 12, 2011 4:30 pm

- College Hoops Affiliation: North Carolina

Re: Puterbac News Network and Political Discussion Thread

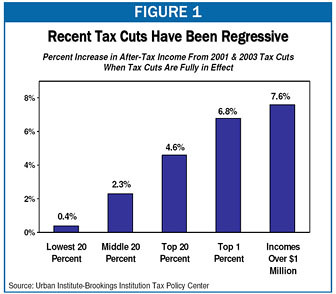

And as the New York Times uncovered in 2006, the 2003 Bush dividend and capital gains tax cuts offered almost nothing to taxpayers earning below $100,000 a year. Instead, those windfalls reduced taxes "on incomes of more than $10 million by an average of about $500,000." As the Times explained in a jaw-dropping chart: "The top 2 percent of taxpayers, those making more than $200,000, received more than 70% of the increased tax savings from those cuts in investment income."

Take life with a pinch of salt, a wedge of lime, and a shot of tequila

- Dora

- Sophomore

- Posts: 322

- Joined: Tue Apr 12, 2011 4:30 pm

- College Hoops Affiliation: North Carolina

Re: Puterbac News Network and Political Discussion Thread

Take life with a pinch of salt, a wedge of lime, and a shot of tequila

- Dora

- Sophomore

- Posts: 322

- Joined: Tue Apr 12, 2011 4:30 pm

- College Hoops Affiliation: North Carolina

Re: Puterbac News Network and Political Discussion Thread

I don't know how to get the whole chart to show up but it's here http://www.nytimes.com/imagepages/2006/ ... chart.html

Take life with a pinch of salt, a wedge of lime, and a shot of tequila

- Professor Tiger

- All-American

- Posts: 9889

- Joined: Wed Apr 06, 2011 11:26 pm

- College Hoops Affiliation: Auburn

- Mascot Fight: Big Cat/Tiger/Lion/Etc

Re: Puterbac News Network and Political Discussion Thread

In the past, I have generally agreed with the conservatives that tax cuts increase - not decrease - tax revenues.

But former Fed Chairman Alan Greenspan sides with the liberals on this question. He's no class warrior.

But former Fed Chairman Alan Greenspan sides with the liberals on this question. He's no class warrior.

“We hold these truths to be self-evident… by the — you know — you know the thing.” - Democrat Presidential Candidate Joe Biden

- Owlman

- Senior

- Posts: 4222

- Joined: Mon Mar 28, 2011 10:04 am

- College Hoops Affiliation: Rice

- Mascot Fight: Bear/Grizzly/Etc

- Location: Louisiana

Re: Puterbac News Network and Political Discussion Thread

HAH! Like children of baby boomers want their parents to move in with them. They'll pay to make sure that's not the case.innocentbystander wrote:Of course they could.Dora wrote:Nope, there is no way they could support me with the amount of FICA taxes they pay.Better be careful. Your kids may get tired of paying huge taxes for a ponzi scheme. Better off paying for you themselves.

Sell YOUR house, move into one room in THEIR house.

You are supported.

My Dad is my hero still.

- Owlman

- Senior

- Posts: 4222

- Joined: Mon Mar 28, 2011 10:04 am

- College Hoops Affiliation: Rice

- Mascot Fight: Bear/Grizzly/Etc

- Location: Louisiana

Re: Puterbac News Network and Political Discussion Thread

What??? YOU voted for Gore in 2000? That was the primary proposal of Gore in the election, to put SS in a lockbox and to truly and accurately reflect the budget (one of the biggest jokes on SNL was Gore repeating lockbox over and over)Hacksaw wrote: You conveniently believed what you chose to believe and voted for people who kept the scam going.

My Dad is my hero still.

- Owlman

- Senior

- Posts: 4222

- Joined: Mon Mar 28, 2011 10:04 am

- College Hoops Affiliation: Rice

- Mascot Fight: Bear/Grizzly/Etc

- Location: Louisiana

Re: Puterbac News Network and Political Discussion Thread

2007And why, if cutting taxes is such a boost to the economy, did the revenues actually start to collapse in 2008?

My Dad is my hero still.

-

puterbac

- Senior

- Posts: 1219

- Joined: Tue Apr 12, 2011 12:11 pm

- College Hoops Affiliation: Tennessee

- Mascot Fight: Bear/Grizzly/Etc

Re: Puterbac News Network and Political Discussion Thread

I can only post the IRS numbers so many times.Professor Tiger wrote:In the past, I have generally agreed with the conservatives that tax cuts increase - not decrease - tax revenues.

But former Fed Chairman Alan Greenspan sides with the liberals on this question. He's no class warrior.

W cuts put fully in place and revenue grew each from 2003 to 2007 before real estate crash and millions fewer paying taxes in 2008.

I posted the links from Oprama's own sites for it. Even the raw excel file. Not much else I can do if you think the sky is a different color.

-

puterbac

- Senior

- Posts: 1219

- Joined: Tue Apr 12, 2011 12:11 pm

- College Hoops Affiliation: Tennessee

- Mascot Fight: Bear/Grizzly/Etc

Re: Puterbac News Network and Political Discussion Thread

And who received the largest percentage decrease in taxes?Dora wrote:

The friggin lowest income earners.

Now I know its hard to comprehend, but you can't give a 500,000 dollar tax cut to people that pay only 1,000 in income taxes.

The bottom brackets saw the largest cuts.

-

puterbac

- Senior

- Posts: 1219

- Joined: Tue Apr 12, 2011 12:11 pm

- College Hoops Affiliation: Tennessee

- Mascot Fight: Bear/Grizzly/Etc

Re: Puterbac News Network and Political Discussion Thread

Once again the data from the IRS:

http://www.irs.gov/pub/irs-soi/08in03etr.xls

Total income tax share (percentage): This is the percentage of TOTAL income tax paid by top percentage of income:

Top 0.1% from 2001 to 2008 (latest year IRS has records for): Share dropped from 2001 to 2002 even though the only the bottom two brackets changed. Drop is due to market losses and less cap gains. Then from 2002 to 2007 the % paid by the top 0.1 % increases every year and in fact sees the biggest jump in % paid the 2 yrs following W tax cuts that lowered their bracket. They PAID a HIGHER % of all income taxes despite their tax bracket being lowered.

2001 16.06

2002 15.43

2003 15.68

2004 17.44

2005 19.26

2006 19.56

2007 20.19

2008 18.47

Its the SAME for each percent level of income earned including the top 50.

In 2001 the BOTTOM 50% of income earners paid 3.97% of all income taxes.

In 2002 it was 3.5%

In 2003 it was 3.46%

In 2004 it was 3.3%

In 2005 it was 3.03%

In 2006 it was 2.99%

In 2007 it was 2.89%

And in 2008 it was 2.7%

The lowest 50 percent of income earners have paid a smaller and smaller percentage of all income taxes EVERY year from 2001 to 2008. That is the definition of progressive taxation. The top 50, 25, 10, 5, 4, 3, 2, 1, 0.1 percent ALL paid a higher percentage of income taxes when the cuts were passed.

W's tax cuts made the tax code MORE progressive not less. People paid more in taxes despite tax cuts because they made more money. This is a good thing.

http://www.irs.gov/pub/irs-soi/08in03etr.xls

Total income tax share (percentage): This is the percentage of TOTAL income tax paid by top percentage of income:

Top 0.1% from 2001 to 2008 (latest year IRS has records for): Share dropped from 2001 to 2002 even though the only the bottom two brackets changed. Drop is due to market losses and less cap gains. Then from 2002 to 2007 the % paid by the top 0.1 % increases every year and in fact sees the biggest jump in % paid the 2 yrs following W tax cuts that lowered their bracket. They PAID a HIGHER % of all income taxes despite their tax bracket being lowered.

2001 16.06

2002 15.43

2003 15.68

2004 17.44

2005 19.26

2006 19.56

2007 20.19

2008 18.47

Its the SAME for each percent level of income earned including the top 50.

In 2001 the BOTTOM 50% of income earners paid 3.97% of all income taxes.

In 2002 it was 3.5%

In 2003 it was 3.46%

In 2004 it was 3.3%

In 2005 it was 3.03%

In 2006 it was 2.99%

In 2007 it was 2.89%

And in 2008 it was 2.7%

The lowest 50 percent of income earners have paid a smaller and smaller percentage of all income taxes EVERY year from 2001 to 2008. That is the definition of progressive taxation. The top 50, 25, 10, 5, 4, 3, 2, 1, 0.1 percent ALL paid a higher percentage of income taxes when the cuts were passed.

W's tax cuts made the tax code MORE progressive not less. People paid more in taxes despite tax cuts because they made more money. This is a good thing.

Re: Puterbac News Network and Political Discussion Thread

You miss the point.

1. The Tax cuts did little for the low income workers. As we've already established, these workers pay little income tax, they pay mostly payroll tax. The Bush tax cuts were designed to drastically cut the tax rates paid by the wealthy, and the success of Bush's plan is plainly visible in the chart Dora posted.

2. Such cuts directed at the wealthy do little to boost the economy because the wealthy people, who received the vast majority of the Tax savings, didn't spend the money. They invested it in China.

1. The Tax cuts did little for the low income workers. As we've already established, these workers pay little income tax, they pay mostly payroll tax. The Bush tax cuts were designed to drastically cut the tax rates paid by the wealthy, and the success of Bush's plan is plainly visible in the chart Dora posted.

2. Such cuts directed at the wealthy do little to boost the economy because the wealthy people, who received the vast majority of the Tax savings, didn't spend the money. They invested it in China.

You are making a logical mistake of assuming a cause and effect relationship. Revenues increased after the Bush Tax cuts in spite of the tax cuts not because of them. This is plainly shown by the 2 trillion dollar difference between the actual receipts and the numbers in the CBO estimate made before Bush's Cuts.W cuts put fully in place and revenue grew each from 2003 to 2007 before real estate crash and millions fewer paying taxes in 2008.

Re: Puterbac News Network and Political Discussion Thread

This is not "the definition of progressive taxation. "The lowest 50 percent of income earners have paid a smaller and smaller percentage of all income taxes EVERY year from 2001 to 2008. That is the definition of progressive taxation. The top 50, 25, 10, 5, 4, 3, 2, 1, 0.1 percent ALL paid a higher percentage of income taxes when the cuts were passed.

Did it ever occur to you that the bottom 50% paid a lower percentage of the total taxes because they were making a lower percentage of the total income each year? Is it not also possible that this effect is partly due to wealthy tax payers paying more taxes because they were selling off capital assets due to lower capital gains rates?

Stats can elucidate, but they can also obscure. You have a tendency to present voluminous quantities of numbers with little useful analysis. Bottom line: your numbers don't serve your argument well because you offer no real analysis; in addition, your data is poorly organized and not clearly presented.

- Owlman

- Senior

- Posts: 4222

- Joined: Mon Mar 28, 2011 10:04 am

- College Hoops Affiliation: Rice

- Mascot Fight: Bear/Grizzly/Etc

- Location: Louisiana

Re: Puterbac News Network and Political Discussion Thread

tax revenue dropped in 2007, the economic crash was 2008

My Dad is my hero still.

- Toemeesleather

- Senior

- Posts: 3220

- Joined: Wed Apr 06, 2011 8:43 am

Re: Puterbac News Network and Political Discussion Thread

Such cuts directed at the wealthy do little to boost the economy because the wealthy people, who received the vast majority of the Tax savings, didn't spend the money. They invested it in China

LMAO.....and jobs are created by low skill poor folks.

LMAO.....and jobs are created by low skill poor folks.

I saw a werewolf drinking a pina colada at Trader Vic's.